MyAccountAccess

MyAccountAccess is simple to use and accessible from anywhere in the world, whether you are at home or work. No worries if you have more than one credit card. MyAccountAccess helps you manage your account and is a simple way to handle it. My Account Access is responsible for managing your credit card and associated files. You can look at your account file anytime.

www.myaccountaccess.com is a secure website for managing multiple credit cards, allowing users to access and use their cards from a single location. MyAccountAccess.com stores people’s credit or debit card information online. My Account access account is used to manage cardholders’ accounts, pay bills, load money onto cards, pay cards, and perform a variety of other transactions.

MyAccountAccess is the safest way to track all funds in accounts that have multiple credit cards. People can handle their payments, balance, and make changes to their profile online.Here, I have provided all the information regarding my account access.

What is MyAccountAccess ?

MyAccountAccess is an online credit card management portal provided by USA Bank. Using this platform, users can easily manage their credit card accounts. Logging into myaccountaccess, you can check your balance, View Transaction history, Make Online bill payments, download your credit card statement, and set up autopay.

Myaccountaccess is user-friendly and secure, available 24/7 from anywhere.

Who can use MyAccountAccess?

MyAccountAccess is specially designed for Elan Financial Services and U.S. Bank credit card holders.

If you have a U.S. Bank Credit Card or an Elan Financial Credit Card, then this portal is for you. You can register and log in to manage your account. Both Business card holders and personal card users benefit from this portal.

Features of MyAccountAccess

MyAccountAccess provides many powerful features that make credit card management easy and secure. Some of the key features include:

- With MyAccountAccess, users can easily manage their credit card accounts online.

- You can check your balance, review available credit, view recent activity, and download statements, all from one easy dashboard.

- MyAccountAccess is secure as it uses advanced encryption technology to protect your information.

- Moreover, My Account Access provides two-step verification to keep your account safe from unauthorized access.

- MyAccountAccess is that it’s available anytime, anywhere.

- Users can pay their credit card bills online directly through the portal.

- In addition, MyAccountAccess keeps a complete record of your transaction history and past statements, making it easier to track and manage expenses.

How to Register on My Account Access at www myaccountaccess com ?

If you are a new user, you will need to create an online account before you can access your credit card details.

- Visit the Official Website of my account access at www.myaccountaccess.com.

- On the login page, find the Register for Online Access link and click it.

- Provide your credit card number and other details requested on the enrollment form.

- Answer security questions or provide additional information to confirm you are the cardholder.

- Choose a username and password for your MyAccountAccess profile.

- Select security questions and answers for account recovery and enable two-factor authentication.

- Review your details and submit the form.

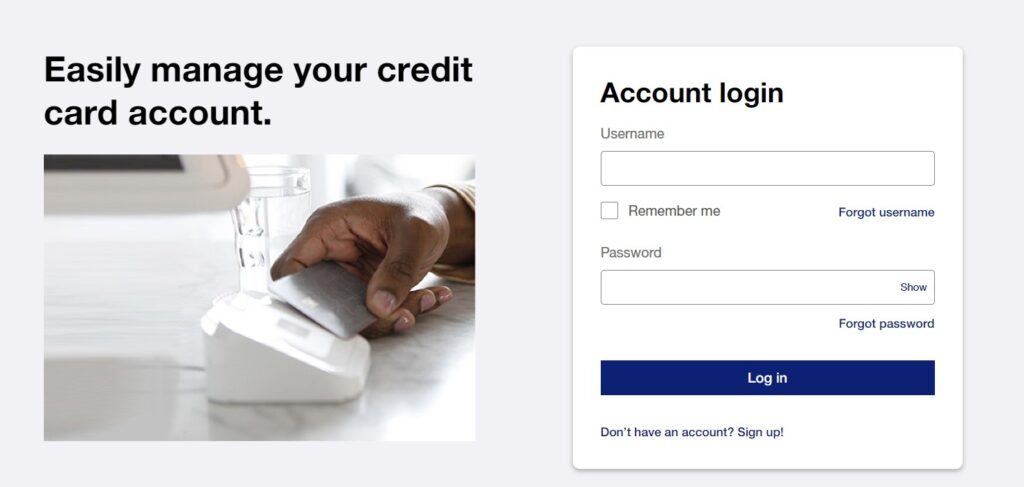

MyAccountAccess Login Guide using myaccountaccess.com

- Go to the Login website, myaccountaccess.com.

- Enter Your User ID and Your Password

- Then, press the Log In button to access your account dashboard.

- Once logged in, you can view statements, pay bills, and manage transactions.

MyAccount Access Username or Password Recovery

If you forget your login details, you can easily recover them:

- If you’ve forgotten your User ID, then “Forget User ID” on the login page. Enter your credit card number and follow the instructions to retrieve your user ID.

- If you’ve forgotten your password, click “Forgot Password.” Enter your User ID and required details. Follow the steps to reset your password securely.

- You may be asked to answer security questions or receive a verification code via email/SMS.

MyAccountAccess Mobile Access

Managing your credit card is even easier with MyAccountAccess mobile access. Whether you are using an iPhone or an Android device, you can log in to your account on the go and enjoy full control of your credit card management.

- iOS (Apple Devices): The official MyAccountAccess app can be downloaded from the Apple App Store.

- Android Devices: The app is available on the Google Play Store.

Common Issues & Troubleshooting on MyAccountAccess

Users may encounter issues such as login errors, forgotten credentials, or technical glitches.

- Login Errors: Check your User ID/Password, clear browser cache, update your browser, or disable VPN.

- Forgot Password/Username: Use the Forgot User ID or Forgot Password links on the login page to reset or recover details.

- Technical Issues: Update or reinstall the mobile app, check your internet connection, or contact support if your account gets locked.

Customer Support for MyAccountAccess

If you face issues, MyAccountAccess offers reliable support:

- Toll-Free Number: Call the number on the back of your credit card for direct assistance.

- Online Help: Visit www.myaccountaccess.com → Contact Us section.

Elan Financial Services – Credit Card Management

Elan Financial Services is one of the leading credit card issuers in the United States, providing a wide range of personal and business credit cards. If you hold an Elan credit card, you can easily manage your account through the MyAccountAccess portal.

Why Choose an Elan Credit Card?

- Wide variety of credit card options (cash back, rewards, business cards, travel cards).

- Competitive interest rates and benefits.

- Backed by U.S. Bank’s secure financial network.

Elan Credit Card Login with MyAccountAccess

To manage your Elan Financial credit card, simply use the Elan credit card login page available at www.myaccountaccess.com. Through this portal, cardholders can:

- Check balances and available credit

- View and download monthly statements

- Make online bill payments

- Track transaction history

- Set up alerts and account reminders

Benefits of Using MyAccountAccess for Elan Cardholders

If you have an Elan card, the My Account Access portal makes it convenient to control your finances. Whether you need to pay bills, check credit usage, or review transactions, everything is available online 24/7.

In Conclusion

MyAccountAccess is a reliable and convenient platform that allows credit card holders to stay in full control of their accounts. From checking balances and paying bills to downloading statements and setting up alerts, everything can be managed online — anytime and anywhere. The secure login system and mobile access make it even more practical for daily use. If you have any queries or suggestions, please feel free to contact us. Our team will be happy to assist you.

This website is for informational purposes only and is not the official MyAccountAccess site.

FAQs – MyAccountAccess

Whether you use a Mastercard®, Visa®, or American Express®, your credit card comes with exclusive benefits and perks available only to customers.

Elan Financial is not a credit card itself. Instead, it’s a business that works with banks and credit unions to issue credit cards with their own names on them, like the Fidelity Rewards Visa Signature Card.

Where can I check my current credit cap? Where can I find my current Credit Limit, Line of Credit, or Revolving Credit Line? It’s in the Activity Summary box on the first page of my monthly account. You can also call the number on the back of your credit card to talk to Cardmember Service.

The best things about myaccountaccess.com are that you can easily handle your account online 24 hours a day, seven days a week. You can pay your bills, see your statements and activity, and set up alerts for changes to your account or possible fraud.

You can include as many credit cards as you want.

www.myaccountaccess.com is the home of the MyAccountAccess site.